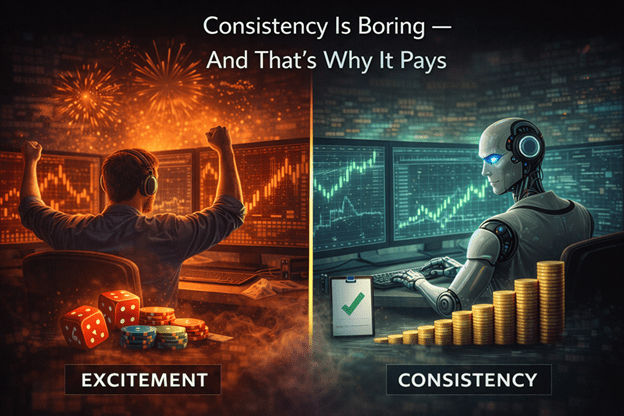

Most traders say they want consistency, but very few are willing to live with what consistency actually looks like. In Forex trading, consistency is slow, repetitive, and often unexciting. And that is precisely why it works.

Retail traders are conditioned to chase excitement. Big wins, fast account growth, and dramatic equity curves feel rewarding. Unfortunately, this mindset leads to overtrading, oversized positions, and emotional decision-making. The result is usually the same: short bursts of profit followed by deep drawdowns or blown accounts.

Professional traders think differently. They understand that consistency is not about winning big, it’s about losing small. A consistent system produces modest gains, accepts losses without emotional reaction, and avoids unnecessary risk. Over time, these small, controlled outcomes compound into meaningful growth.

Automation reinforces this discipline. An Expert Advisor does not care whether the market is exciting or slow. It executes the same rules repeatedly, without deviation. This removes the temptation to increase risk during “good” days or chase losses during bad ones. Consistency becomes mechanical, not emotional.

Another reason consistency feels boring is because progress is rarely visible in the short term. A system that grows an account steadily over months will never feel as exciting as one that doubles an account in a week. Yet the first approach survives changing market conditions, while the second often collapses under volatility.

Many traders abandon consistent systems because they mistake boredom for inefficiency. They change strategies too frequently, reset EAs after small drawdowns, or jump to the next “better” setup. In doing so, they prevent compounding from ever taking effect.

In trading, boredom is a sign of discipline. It means rules are being followed and emotions are not in control. Consistency may not satisfy the ego, but it rewards patience.

In the long run, the traders who succeed are not the most excited they are the most consistent.